How to Register a Company in Dubai: Complete Guide for Entrepreneurs

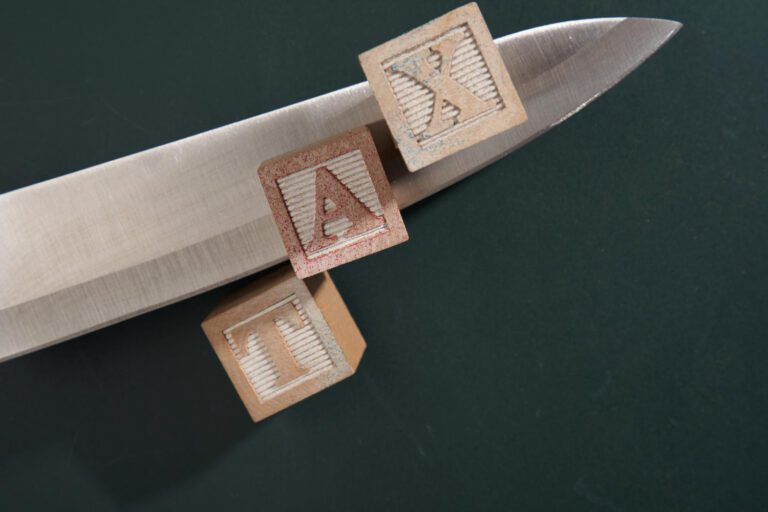

Starting a business in Dubai opens doors to one of the world’s most dynamic economies. With its strategic location, tax-friendly […]

How to Register a Company in Dubai: Complete Guide for Entrepreneurs Read More »